Press Releases - BFF Banking Group

Press Releases

According to the results of the latest IBRiS research and the announcement of the Monetary Policy Council to raise interest rates, starting 11th May BFF increases interest rates on Lokata Facto.

Highlights from the new research commissioned by BFF Bank says that:

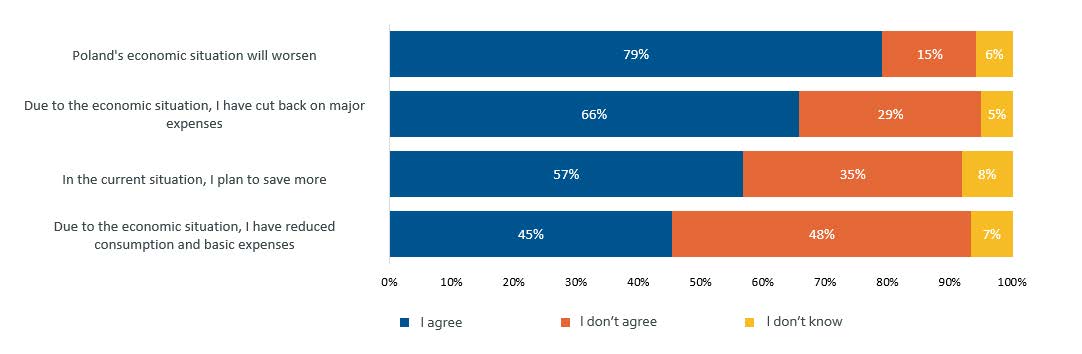

- Almost 80% of respondents expect the economic situation in Poland to deteriorate and state that they have limited their spending due to current conditions; at the same time, over half of respondents plan to save more

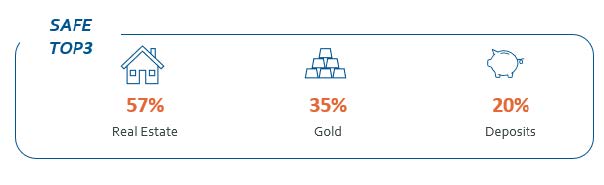

- Real estate is perceived by Poles as the safest form of investment, followed by gold, while term deposits are considered a safe way of saving by every fifth respondent (third place in the ranking)

- Bank brand and solidity becoming increasingly important

Lodz, 09.05.2022 – BFF Bank and its Polish branch have recently carried out research with the IBRiS Market and Social Research Institute to survey customers’ needs at this time of uncertainty, after two years spent fighting the pandemic and the recent war in Ukraine.

In parallel with the increase in interest rates, bank deposits are becoming more and more popular, and customers are paying more attention not only to interest rates, but also to bank brands and the perceived stability of those banks.

The survey shows that as many as eight out of ten respondents expect Poland's economic situation to worsen. Due to the current economic situation, 66% of those surveyed have limited their significant expenses and 45% have limited current consumption and basic expenses. Higher percentages of those stating that they have not reduced their expenses can be observed among men (aged 40 to 60), respondents with a higher level of educational attainment, and those with an income of 3000-5000 PLN/person.

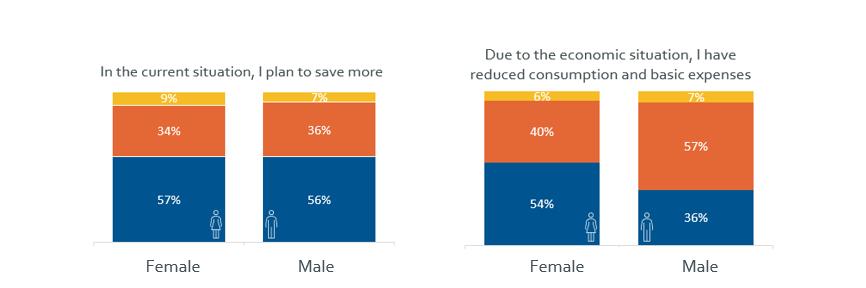

At the same time, 57% of those surveyed stated that due to the current political and economic situation they plan to save more in the near future. Residents of Poland's largest cities and younger respondents (aged under 30) are more likely to plan to increase their savings. Respondents aged 50 to 69, in contrast, most often stated that they have no such intentions.

As shown by the results of the analysis, there are several ways to save that, according to individual bank customers, are currently considered the safest. For the respondents, the safest form of saving is still real-estate investment, which was selected by 57% of those surveyed, followed by gold (at 35%), whereas third place in the ranking was taken by term deposits, which were chosen by 20% of the respondents. Significantly, bank deposits were ranked higher than investment in foreign currencies (16%) and treasury bonds (13%), which until recently were regarded as one of the safest ways to invest savings.

The majority of individual customers of banks operating in Poland – 51% of respondents – expect interest-rate rises to result in higher deposit interest rates. At the same time, the survey – commissioned by BFF Banking Group – reveals that there are three crucial factors which determine the decision on the part of bank customers to choose a specific deposit offering. The most important of these is, of course, the deposit interest rate, which was flagged up by 65% of the respondents, followed by deposit duration (with 29% of clients stating their preferred deposit term as being up to one year), while bank brand came in third, selected by a full 21% of the respondents.

This shows just how important the stability of the bank to which they entrust their savings is for individual customers – a factor that is especially important in today's rapidly changing geopolitical and economic context.

Bank brand and bank stability are also associated with high levels of customer trust, in both Polish and foreign institutions. The results of the survey conducted by IBRiS and BFF Banking Group demonstrate that 40% of the surveyed clients trust Western European banks (22% have no opinion on the matter).

Krzysztof Kawalec, Head of BFF in Poland, stated: ”Part of our commitment as BFF is towards knowing our clients’ needs and expectations. This helps to improve quality, facilitating product innovation and the provision of support to clients in periods of uncertainty. We offer our clients Lokata Facto, a highly competitive and secure savings product, providing them with a wide range of short, medium and long-term bank deposits. Following the MPC's decision to raise interest rates and the government's recent recommendations to improve the deposit offering, we are proud to announce that we have immediately disposed an increase in interest rates on our deposits, Lokata Facto, starting 11th May.”

***

The survey was conducted by the IBRiS Market and Social Research Institute by means of standardized computer-assisted telephone questionnaire interviews (CATI) between 30.03 and 06.04.2022 on a representative sample of 1002 people.

***

BFF Banking Group

BFF Banking Group is the largest independent specialty finance in Italy and a leading player in Europe, specialized in the management and non-recourse factoring of trade receivables due from the Public Administrations, in Securities Services, Banking and Corporate payments. The Group operates in Italy, Croatia, Czech Republic, France, Greece, Poland, Portugal, Slovakia and Spain. BFF is listed on the Italian Stock Exchange. In 2021 it reported a consolidated Adjusted Net Income of €125.3 million, with a 17.6% Group CET1 ratio at the end of December 2021. www.bff.com

Lokata Facto

Lokata Facto is operated by BFF Bank S.p.A. Spółka Akcyjna Branch in Poland, which is part of the BFF Banking Group. Lokata Facto is a savings term deposit account for consumers and a term deposit account for entrepreneurs. The client may deposit funds with Lokata Facto for 1,3, 6, 9, 12, 18, 24, 36, 48 or 60 months. The minimum Lokata amount is 5000 PLN and there is no maximum limit for a single deposit. Interest on the deposit shall be capitalized at the end of the contractual period, unless the terms and conditions of the deposit state otherwise. The free Deposit Account enables the client to freely dispose of funds in accordance with the terms and conditions. Interest is accrued in accordance with the rules set out in the Table of Interest Rates and Fees for Individual Clients. www.lokatafacto.pl

BFF launched deposits in 2014 in Italy. Since then it has raised more than €3 billion in Europe The bank, listed on the Italian Stock Exchange since 2017, is one of the most stable and profitable groups, with a total return of 95.4% since the IPO. Deposits offered by the BFF Banking Group in Italy and throughout Europe are guaranteed by the Interbank Deposit Protection Fund (Fondo Interbancario di Tutela dei Depositi - F.I.T.D.), which is the Italian equivalent of the Polish Bank Guarantee Fund.

Facto Deposit Interest Rate Table effective May 11, 2022:

IBRiS

The IBRiS Market and Social Research Institute (IBRiS, www.ibris.pl) has been operating on the Polish market since 2014. We carry out research projects commissioned by scientific institutes, universities, Polish and foreign government institutions, media, non-governmental organizations and political parties, international concerns, and Polish manufacturing and trading companies operating in sectors such as: finance, energy, transport, services, real estate, FMCG. We offer non-standard, tailor-made solutions developed in response to the unique needs of customers. The aim of IBRiS is to provide the data and knowledge necessary to make key decisions in the fields of politics, business or social activities.